In today’s fast-paced business world, finding the right funding solution can be a crucial step towards success.

One company that has gained attention in the finance industry is Shore Funding Solutions.

As you embark on your search for funding options, it’s important to consider reviews and feedback from real customers.

In this article, we will examine both good and negative reviews of Shore Funding Solutions in order to provide you important information that will help you make wise decisions.

Shore Funding Solutions

| Details | Description |

|---|---|

| Name | Shore Funding Solutions |

| Established | 2014 |

| Headquarters | Melville, New York, United States |

| Type | Financial Services Provider |

| Services | Small business loans, merchant cash advances, equipment financing, etc. |

| Target Audience | Small businesses |

| Funding Options | Flexible eligibility criteria to accommodate a range of businesses |

| Approval Time | Quick response times for funding approval |

| Funding Approval Time | Quick approval times for timely access to funds |

| Transparency | Clear terms and conditions, ensuring transparency |

| Customer Support | Website:www.shorefundingsolutions.com E-mail: [email protected] Phone: 800-980-0472 Address: 2 Huntington Quad, Suite 1N15, 11747 Melville, United States |

How does Shore Funding Solutions work?

Shore Funding Solutions is a reputable funding provider that offers a range of services to businesses across various industries.

They specialize in providing flexible financial options customized specifically to the needs of each of their clients.

Whether you’re a small startup looking to expand or an established business in need of working capital, Shore Funding Solutions aims to offer financial support to propel your growth.

Customer Experiences and Reviews

Shore Funding Solutions Reviews

How to Apply for loan at Shore Funding Solutions?

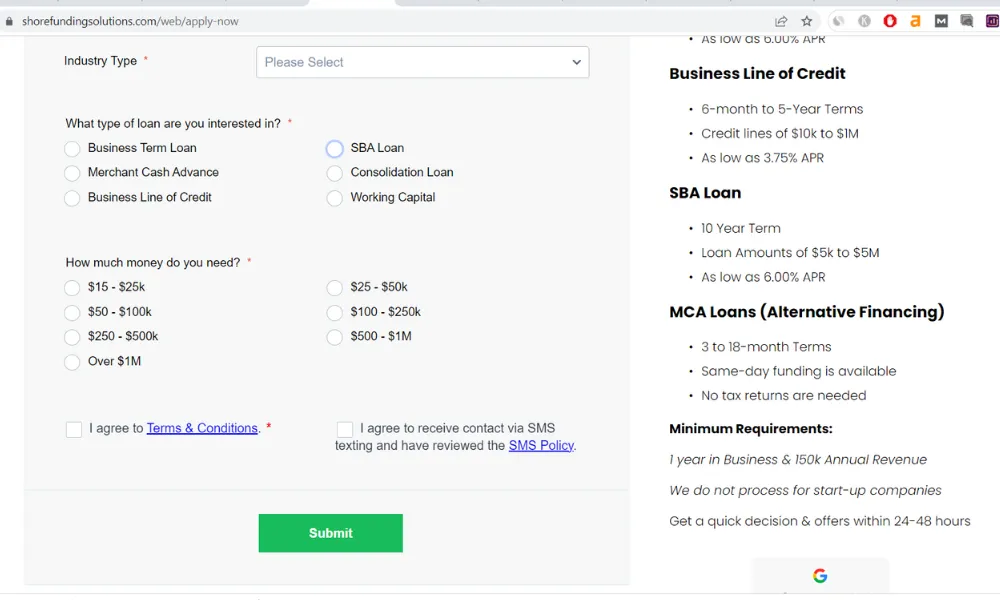

Step 1: Go to www.shorefundingsolutions.com, the official website of Shore Funding Solutions.

Step 2: Look for a section or link on the website specifically dedicated to loan applications. It may be labeled as “Get Started”

Step 3: Fill out the application form with accurate such as your name, address, social security number and contact details.

Step 4: Shore Funding Solutions will require some financial information about your business. This may include revenue figures, profit margins and other relevant financial data.

Step 5: Specify the loan amount you are seeking and the purpose of the funds.

Step 6: Review the information you’ve provided for accuracy and completeness. Once satisfied, submit the application to Shore Funding Solutions for review.

Step 7: If your loan application is approved, a representative from Shore Funding Solutions will reach out to discuss the available funding options, terms and conditions. They will provide you with details about the loan amount, repayment terms, interest rates and any associated fees.

Step 7: If you decide to proceed with the offered funding option, you will need to review and sign a loan agreement. Take the time to thoroughly read and understand the terms and conditions before signing the agreement.

Step 9: Once the loan agreement is signed, Shore Funding Solutions will process the loan and transfer the funds to your designated bank account.

Also see: We Fix Money Reviews

Features of Shore Funding Solutions

- They offer a range of funding solutions tailored to businesses of different sizes and industries.

- Their services include small business loans, merchant cash advances and equipment financing.

- Shore Funding Solutions has flexible eligibility criteria, making their funding options accessible to a wide range of businesses.

- They have a streamlined online application process, ensuring a smooth and efficient experience for applicants.

- Quick funding approval is a priority for Shore Funding Solutions, enabling businesses to access the funds they need promptly.

- One of their key strengths is their ability to customize funding solutions based on the specific needs and goals of each business.

- Shore Funding Solutions emphasizes transparency, providing clear terms and conditions to foster trust and understanding.

- They have a responsive customer support team that is available to assist businesses throughout the funding process.

- With their industry expertise and strong reputation, Shore Funding Solutions has become a trusted choice for businesses seeking reliable financial solutions.

What type of products do Shore Funding Solution provide?

Shore Funding Solution provide following loans services or products:

- Business Term Loan

- Business Line of Credit

- Working Capital Loan

- Business Loans for Women

- Bad Credit Business Loans

- SBA Business Loans

- Secured Business Loans

- Small Business Loans for Minorities

- Business Loans with no Credit Check

To which industries Shore Funding Solution provide loans?

Shore Funding Solution provide loans to the following industries:

- Restaurants

- Plumbers

- Heating Contractors

- Electricians

- Roofing Companies

- Flooring Companies

- HVAC Companies

- Home Renovation Companies

- Towing Companies

- Automotive Repair Shops

- Auto Body Shops

- Landscapers

Pros and Cons of Shore Funding Solutions

- Flexible funding options to cater to diverse business needs.

- Streamlined application process for a quick and hassle-free experience.

- Quick approval times, allowing businesses to access funds promptly.

- Customized funding solutions tailored to individual business requirements.

- Transparent terms and conditions, ensuring clarity and trust.

- Responsive customer support to address inquiries and provide guidance.

- Extensive industry expertise to offer specialized advice and solutions.

- Positive reputation and trustworthiness in the financial services industry.

- Possible eligibility criteria that may restrict access for some businesses.

- Fees and the amount of money you have to pay back when you borrow, can be different depending on the way you choose to get the money.

- Funding amounts may have limitations depending on business circumstances.

- Availability of funding options may vary depending on geographic location.

- Potential additional documentation or collateral requirements for certain funding options.

FAQs

What is Shore Funding Solutions?

hore Funding Solutions is a reputable financial services company offering a range of funding solutions for businesses including loans and merchant cash advances.

Are Shore Funding Solutions reviews trustworthy?

Yes, Shore Funding Solutions reviews are authentic and reliable, reflecting the experiences of actual customers who have utilized their services.

How can Shore Funding Solutions help my business?

Shore Funding Solutions can provide your business with flexible funding options, tailored to your needs, allowing you to grow, invest and overcome financial challenges.

What types of funding does Shore Funding Solutions offer?

Shore Funding Solutions offers various funding options, including small business loans, equipment financing, invoice factoring and lines of credit.

Is the application process with Shore Funding Solutions complicated?

No, the application process with Shore Funding Solutions is streamlined and straightforward, ensuring minimal hassle and quick access to funds for qualified applicants.

ow long does it take to receive funding from Shore Funding Solutions?

Shore Funding Solutions strives to provide prompt funding within 3 to 5 business days.

Does Shore Funding Solutions have strict eligibility requirements?

While Shore Funding Solutions has certain criteria for approval, they cater to a wide range of businesses and offer options for those with less-than-perfect credit.

Are there any hidden fees with Shore Funding Solutions?

Shore Funding Solutions is transparent about fees, ensuring no hidden charges. They provide clear terms and conditions upfront, allowing you to make informed decisions.

Can I pay off my Shore Funding Solutions loan early?

Yes, you can pay off your loan with Shore Funding Solutions ahead of schedule without incurring any prepayment penalties, potentially saving you money on interest.

How can I contact Shore Funding Solutions for further assistance?

For further assistance, you can reach out to Shore Funding Solutions through their website, phone or email.

Final words

Shore Funding Solutions stands out as a reliable and flexible financial services provider for businesses seeking funding solutions.

Through their personalized approach, streamlined processes and commitment to transparency, they empower businesses to achieve their goals and unlock new opportunities.

Do your homework, read reviews and ask for recommendations when making financial decisions to make sure you’re getting the greatest deal for your company.