Long-term care insurance is a valuable financial tool that helps individuals cover the costs associated with long-term care services.

It provides a sense of security and peace of mind, knowing that if the need arises, you will have the financial resources to receive quality care.

Also, not everyone is eligible for long-term care insurance.

In this article, we will discuss about the factors that can disqualify you from obtaining long-term care insurance.

What is Long-Term Care Insurance?

Long-term care insurance is designed to provide coverage for services needed when an individual is unable to perform daily activities independently.

It helps cover costs associated with nursing homes, assisted living facilities, in-home care and other long-term care options.

This insurance is an important consideration, especially as we age and our healthcare needs change.

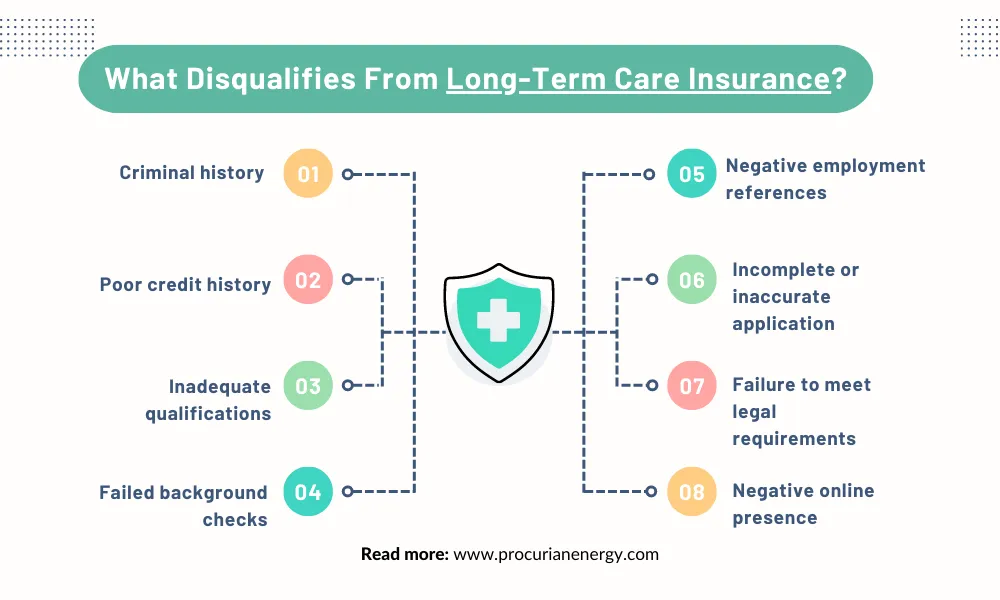

What Disqualifies From Long-Term Care Insurance?

Common factors that can disqualify Applicants for a long-term Care insurance:

1) Criminal history

Applicants with a criminal record, especially for offenses relevant to the position or application, may be disqualified. Serious crimes or convictions related to dishonesty, violence or offenses that pose a risk to others are often considered significant disqualifiers.

2) Poor credit history

In financial contexts such as loan applications, a poor credit history can lead to disqualification. High levels of debt, payment defaults, bankruptcies or a history of financial irresponsibility can raise concerns about an applicant’s ability to manage financial obligations.

3) Inadequate qualifications

Insufficient education, training or experience may disqualify applicants for certain positions or academic programs. Employers or educational institutions often have specific requirements that candidates must meet such as degrees, certifications or relevant work experience.

4) Failed background checks

Background checks are commonly conducted for sensitive positions or roles that require a high level of trust. If a background check reveals red flags such as false information, discrepancies or unethical behavior, it can lead to disqualification.

5) Negative employment references

Poor references from previous employers or supervisors can be detrimental to an applicant’s chances. Negative feedback regarding an applicant’s performance, work ethic or conduct can raise concerns and result in disqualification.

6) Incomplete or inaccurate application

Failure to provide complete and accurate information in an application can raise doubts about an applicant’s attention to detail or integrity. Providing false information, omitting relevant details or providing misleading statements can lead to disqualification.

7) Failure to meet legal requirements

Applicants who do not meet legal requirements, such as age restrictions, citizenship or residency status or specific licensing or certification requirements, may be disqualified from certain positions or opportunities.

8) Negative online presence

In today’s digital age, employers and institutions often review an applicant’s online presence. Inappropriate or offensive content, evidence of unprofessional behavior or posts that conflict with the organization’s values can lead to disqualification.

9) Medical or physical limitations

In some cases, medical or physical limitations may disqualify applicants from certain positions that require specific physical abilities or may pose risks to the applicant’s health and safety.

10) Failure to follow application instructions

Not following the specific instructions outlined in the application process such as missing deadlines, submitting incomplete documentation or not providing required materials, can result in disqualification.

11) Activities of daily living (ADL) limitations

Inability to perform activities of daily living such as bathing, dressing or eating, may disqualify individuals from coverage.

12) Substance abuse and addiction-related issues

If you have a history of substance abuse or addiction, it may affect your eligibility for long-term care insurance. Insurance companies assess the risks associated with providing coverage to individuals with substance abuse issues.

Steps to Take if You Are Disqualified from long-Term Care Insurance

If you find yourself disqualified from long-term care insurance, consider taking the following steps:

- Get a clear understanding of why you were disqualified to identify potential areas for improvement.

- Consulting with experts who specialize in long-term care planning can help you explore alternative options and find the best course of action.

- Investigate government programs, self-insurance strategies and other alternatives to ensure you have a plan in place for your long-term care needs.

- Adopting a healthier lifestyle, managing chronic conditions effectively and addressing any disqualifying factors may increase your chances of qualifying for long-term care insurance in the future.

Alternatives to Long-Term Care Insurance

The other alternative options to consider are:

- Government programs and benefits – Explore Medicaid and Medicare, which provide coverage for long-term care services under certain circumstances.

- Self-insurance and personal savings – Start saving early and set aside funds specifically for long-term care needs.

- Hybrid policies and life insurance with long-term care riders – These policies combine life insurance with long-term care benefits, allowing for flexibility and potential coverage.

- Long-term care annuities and other financial instruments – These products offer long-term care benefits in exchange for a lump-sum payment or regular premiums.

What are the common universal exclusions in a long-term care policy?

Common universal exclusions in a long-term care policy are:

- pre-existing conditions,

- self-inflicted injuries,

- illnesses related to substance abuse,

- wounds received in the course of criminal activity,

- certain mental health conditions.

Additionally, most policies exclude coverage for care resulting from war or acts of terrorism. Some policies may also have specific exclusions for conditions such as Alzheimer’s disease during the first few years of the policy.

What are the chances of requiring long-term care?

The chances of requiring long-term care can vary depending on various factors such as age, health status, lifestyle choices and genetics.

According to the U.S. Department of Health and Human Services, about 70% of people over the age of 65 will require long-term care services at some point.

What are the problems with long-term care?

Problems with long-term care are:

- First, there is a growing demand due to an aging population and increasing prevalence of chronic illnesses.

- Second, the cost of long-term care is often exorbitant, causing financial strain for individuals and families.

- Third, there is a shortage of skilled healthcare professionals, leading to inadequate staffing and lower quality of care.

- Fourth, there are issues related to the quality and safety of care, including instances of neglect and abuse.

- Finally, coordination and integration of care across different settings and providers remain a challenge, leading to fragmented care and poor outcomes.

Under what circumstances is it difficult for clients to purchase long-term care insurance?

Clients may find it difficult to purchase long-term care insurance under various circumstances.

Age can be a limiting factor as insurers often impose age restrictions or charge higher premiums for older individuals.

Financial constraints can be a barrier as long-term care insurance can be expensive and clients may struggle to afford the premiums.

Lack of awareness or understanding about the benefits and importance of long-term care insurance may discourage potential clients from pursuing it.

The complex and ever-changing nature of insurance policies can make the decision-making process challenging for clients.

What causes a qualified long-term care insurance policy to lose its tax qualified status?

A qualified long-term care insurance policy can lose its tax qualified status if it no longer meets certain criteria set by the Internal Revenue Service (IRS).

Some potential causes are:

- Changes made to the policy that no longer comply with the IRS guidelines,

- Premium payments not being made as required,

- Policy not meeting the definition of a qualified long-term care insurance contract as defined by the IRS.

What is not excluded in a long-term care policy?

In a long-term care policy, certain expenses and services are typically not excluded. These are:

- nursing home care,

- assisted living facilities,

- home healthcare services,

- adult daycare,

- hospice care.

What is one of the most important regulatory issues in long-term care insurance?

One of the most important regulatory issues in long-term care insurance is ensuring consumer protection and solvency.

Regulations focus on preventing fraudulent practices, ensuring fair and transparent policies and enforcing financial stability of insurance providers.

Are long-term care premiums limited?

Long-term care insurance premiums are not limited and they can vary based on various factors such as the age, health and coverage level of the insured person.

Premiums can increase over time due to inflation or changes in the insurance market

When no long-term care policy may exclude pre-existing conditions?

Long-term care policies may exclude coverage for pre-existing conditions, meaning that expenses related to those conditions would not be covered.

One such instance is when the policy includes a “guaranteed issue” provision, which means that the policy must be offered to individuals without considering their pre-existing conditions.

It’s important to review the terms and conditions of a particular policy to determine whether pre-existing conditions are excluded or covered.

What is LTC insurance not designed to provide coverage for?

Long-term care (LTC) insurance does not cover acute medical conditions or treatments, such as surgeries, hospital stays or medications for short-term illnesses.

Additionally, LTC insurance usually excludes coverage for conditions arising from self-inflicted injuries, alcohol or drug abuse or injuries resulting from criminal activities.

LTC insurance does not cover care provided by family members or friends unless they are qualified healthcare professionals.

FAQs

What medical conditions can disqualify you from long-term care insurance?

Certain conditions like Alzheimer’s, Parkinson’s and advanced cancer may disqualify you from coverage due to the high risk of requiring long-term care.

Does age play a role in disqualification for long-term care insurance?

Age alone doesn’t disqualify you but some policies may have age restrictions and the premiums may increase significantly as you get older.

Can pre-existing conditions affect eligibility for long-term care insurance?

Yes, pre-existing conditions like diabetes, heart disease or stroke may lead to disqualification or result in higher premiums due to increased risk.

Are mental health disorders a disqualifying factor for long-term care insurance?

Not necessarily, but severe mental illnesses like schizophrenia or bipolar disorder may affect eligibility, as they may require long-term care.

Can a history of substance abuse prevent you from obtaining long-term care insurance?

A past or current substance abuse problem might disqualify you from coverage due to the associated health risks and potential need for specialized care.

Does a physical disability automatically disqualify you from long-term care insurance?

No, a physical disability alone doesn’t disqualify you, but it may impact eligibility if it significantly increases the likelihood of requiring long-term care.

Will a high body mass index (BMI) make you ineligible for long-term care insurance?

A high BMI itself won’t disqualify you but severe obesity can increase the risk of health issues, potentially affecting your eligibility or premiums.

Can a history of certain surgeries or medical procedures disqualify you?

Past surgeries or procedures generally don’t disqualify you but if they indicate a high likelihood of future care needs, it may affect eligibility or premiums.

Does a family history of certain diseases impact long-term care insurance eligibility?

While family history is considered, it doesn’t disqualify you. However, if genetic conditions increase your risk, it may affect your eligibility or premiums.

Are certain occupations or hazardous hobbies a disqualifying factor?

Certain high-risk occupations or hobbies may affect eligibility, as they increase the likelihood of accidents or injuries requiring long-term care.

Final words

Long-term care insurance provides valuable coverage but it’s very important to be aware of the factors that can disqualify you from obtaining this type of insurance.

Understanding the exclusions and limitations as well as exploring alternative options can help you make informed decisions when it comes to planning for your long-term care needs.

By being proactive and considering various strategies, you can ensure financial security and peace of mind for yourself and your loved ones.

I hope you found this article by Procurian helpful about what disqualifies you from long-term care insurance.

Thankyou!