When it comes to financing your real estate ventures or commercial properties, understanding the different loan options available is crucial.

One such option is the Debt Service Coverage Ratio (DSCR) loan.

To assist you in making judgments about your financing requirements, we will examine the pros and cons of DSCR loans in this article.

What is a DSCR Loan?

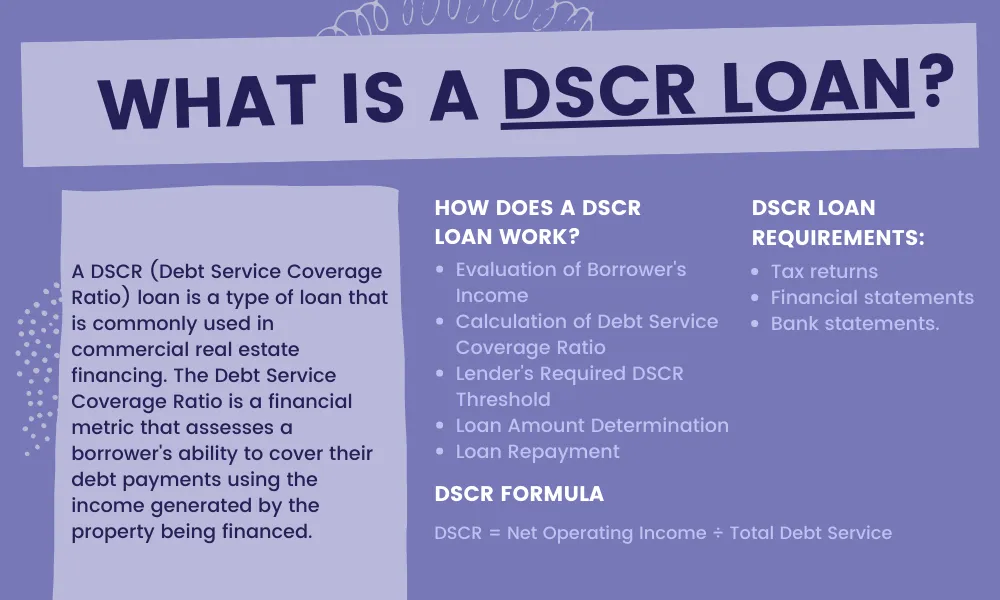

A DSCR (Debt Service Coverage Ratio) loan is a type of loan that is commonly used in commercial real estate financing. The Debt Service Coverage Ratio is a financial metric that assesses a borrower’s ability to cover their debt payments using the income generated by the property being financed.

In a DSCR loan, the lender evaluates the income generated by the property and compares it to the debt obligations associated with the loan, including principal and interest payments.

The lender calculates the Debt Service Coverage Ratio by dividing the property’s net operating income (NOI) by the annual debt service.

The DSCR indicates the property’s ability to generate sufficient income to cover its debt obligations. Lenders typically require a minimum DSCR ratio to ensure the borrower has a reliable income stream to meet their loan payments.

A higher DSCR ratio, such as 1.25 or 1.5, is generally preferred by lenders as it indicates a greater ability to cover debt payments.

Also See: What is a Bridge Loan in Commercial Real Estate?

DSCR Loan Pros and Cons

| S.No. | Pros | Cons |

|---|---|---|

| 1 | Favorable loan terms | Strict qualification requirements |

| 2 | Lower interest rates | Potential collateral requirements |

| 3 | Long repayment periods | Limited flexibility in loan use |

| 4 | Improved cash flow | Potential for higher debt obligations |

| 5 | Enhanced creditworthiness | Risk of default in case of income loss |

| 6 | Lenders prefer DSCR loans | Time-consuming application process |

| 7 | Higher loan amounts | Higher fees and closing costs |

| 8 | Lower debt burden | Possible impact on personal credit |

| 9 | Option for fixed interest | Limited availability in some markets |

| 10 | Potential tax benefits | Reduced control over financial decisions |

Pros of DSCR Loans

The pros of DSCR Loans are:

1) Lower interest rates compared to traditional loans

DSCR loans often come with lower interest rates, making them an attractive option for borrowers. This can lead to significant savings over the course of the loan term and enhance your overall profitability.

2) Enhanced cash flow management

By utilizing DSCR loans, you can better manage your property’s cash flow. Since the loan repayment is based on the property’s income rather than your personal finances, you can allocate funds for other business expenses, property maintenance or future investments.

3) Flexibility in repayment options

DSCR loans offer flexibility in terms of repayment options. Lenders understand the cyclical nature of businesses and provide options such as interest-only payments or seasonal payment structures, which can be beneficial for businesses with fluctuating revenue streams.

4) Potential for higher loan amounts

DSCR loans often allow for higher loan amounts compared to traditional loans. This can be advantageous when financing commercial properties or large-scale real estate projects, providing you with the necessary capital to pursue your ambitions.

5) Favorable terms for investment properties

DSCR loans are especially favorable for investment properties. Lenders assess the property’s income-generating potential and focus on its ability to cover the loan payments. This means that even if your personal financial situation is not as strong, you can still secure financing based on the property’s profitability.

Cons of DSCR Loans

The cons of DSCR Loans are-

1) Stricter qualification requirements

DSCR loans typically have stricter qualification requirements. Lenders analyze the property’s cash flow and your creditworthiness in detail. This means you need to have a solid financial track record and a property with a reliable income stream to meet the lender’s criteria.

2) Limited loan availability for certain property types

DSCR loans may not be available for all types of properties. Lenders tend to focus on income-generating properties such as commercial buildings, multi-family units, or rental properties. If you are seeking financing for other property types, you may need to explore alternative loan options.

3) Potential for higher down payment requirements

To mitigate risk, lenders may require a higher down payment for DSCR loans. This can be a challenge, especially if you are seeking substantial financing. Be prepared to have a significant amount of capital available to meet the lender’s requirements.

4) Risk of property value fluctuations impacting loan terms

DSCR loans are directly tied to the property’s income. If the property’s value declines or its income stream weakens, it can affect the loan terms. In such cases, lenders may demand additional collateral or revise the loan agreement, potentially putting you at a disadvantage.

5) Prepayment penalties and restrictions

Some DSCR loans may come with prepayment penalties or restrictions. These clauses limit your ability to pay off the loan early or refinance without incurring additional costs. Carefully review the terms and conditions of the loan to understand any potential limitations.

Is the DSCR loan worth it?

The worth of a Debt Service Coverage Ratio (DSCR) loan depends on various factors such as:

- your financial situation,

- the purpose of the loan,

- the terms offered.

DSCR loans can provide favorable terms and help ensure you can meet your loan obligations.

It’s important to carefully assess your ability to generate sufficient cash flow to cover the debt payments before deciding if a DSCR loan is worth it for your specific circumstances.

What is the average interest rate for a DSCR loan?

The average interest rates for DSCR loans ranged from around 7.37% to 8.62%.

It can vary depending on various factors such as the lender, borrower’s creditworthiness, loan term and prevailing market conditions.

Can you refinance out of a DSCR loan?

No, you cannot refinance out of a Debt Service Coverage Ratio (DSCR) loan since the DSCR is a key factor used to assess the borrower’s ability to repay the loan.

Refinancing typically involves obtaining a new loan, and lenders would still consider the borrower’s DSCR as part of the evaluation process.

Are DSCR loans more expensive?

DSCR (Debt Service Coverage Ratio) loans are typically not more expensive in terms of interest rates compared to traditional loans.

However, they may require a higher down payment and have stricter eligibility criteria, which can increase upfront costs.

How do you size a loan for a DSCR?

To size a loan based on Debt Service Coverage Ratio (DSCR), you need to:

- Calculate the borrower’s net operating income (NOI) by subtracting operating expenses from the property’s gross income.

- Then, divide the NOI by the required DSCR to determine the maximum allowable debt service.

- Finally, based on the lender’s terms, interest rates and loan duration, determine the loan amount that fits within the calculated debt service limit.

What is the net operating income for DSCR?

Net Operating Income (NOI) is a financial metric used in the calculation of Debt Service Coverage Ratio (DSCR).

It represents the total revenue generated by a property minus operating expenses, excluding any financing costs.

NOI is an important factor in determining the ability of an income-producing property to cover its debt obligations.

Does DSCR include taxes and insurance?

No, the Debt Service Coverage Ratio (DSCR) does not include taxes and insurance.

DSCR is a financial metric used to assess the ability of a borrower to cover their debt obligations with available income.

Taxes and insurance are separate expenses that are not factored into the DSCR calculation.

Do DSCR loans look at DTI?

No, Debt Service Coverage Ratio (DSCR) loans primarily focus on the borrower’s ability to generate sufficient cash flow to cover loan payments, while Debt-to-Income Ratio (DTI) loans assess the borrower’s monthly debt obligations compared to their income.

DSCR loans prioritize cash flow analysis, while DTI loans consider a broader picture of debt obligations.

Does a DSCR loan affect credit score?

Yes, a DSCR (Debt Service Coverage Ratio) loan can potentially affect your credit score.

While the loan itself may not directly impact your credit score, your ability to manage and repay the loan can have an indirect effect.

If you consistently make timely payments and maintain a healthy DSCR, it can positively impact your credit score.

In contrast, it could negatively impact your credit score if you find it difficult to make your loan installments and default.