Welcome to ProCurian!

Securing financing is a crucial step in any real estate investment venture.

One option that investors often consider is obtaining a DSCR loan, also known as a Debt Service Coverage Ratio loan.

This type of loan assesses the property’s ability to generate sufficient income to cover the debt payments.

In this blog, we will explore the steps and strategies involved in obtaining a DSCR loan for your real estate investments.

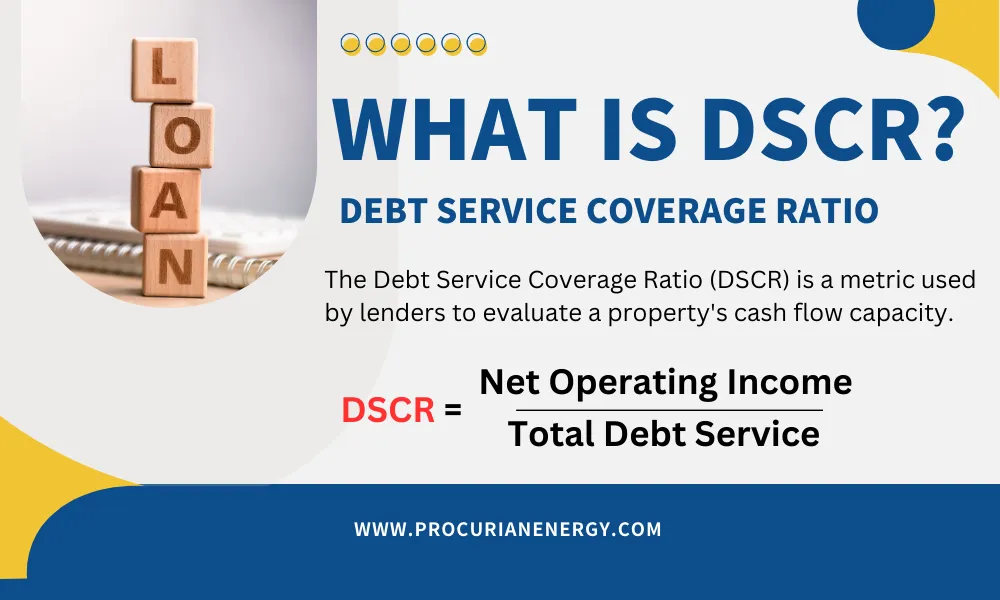

Wha is DSCR (Debt Service Coverage Ratio)?

The Debt Service Coverage Ratio (DSCR) is a metric used by lenders to evaluate a property’s cash flow capacity.

It measures the property’s ability to generate enough income to cover its debt obligations.

Here is the formula for calculating DSCR:

| DSCR = Net Operating Income ÷ Total Debt Service |

What is a Good & Bad DSCR?

DSCR of 1.0 or higher is considered good which shows that the borrower’s cash flow is sufficient to cover their debt payments.

DSCR below 1.0 is considered bad, as it suggests that the borrower’s cash flow is insufficient to cover their debt payments.

Also See: 7 Best Options To Get A Loan With No Credit

How does a DSCR Loan work?

The DSCR ratio indicates the number of times the net operating income covers the debt service.

A ratio greater than 1 means that the net operating income is sufficient to cover the debt payments, which is generally considered favorable.

Lenders typically prefer a higher DSCR ratio as it indicates a lower risk of default. However, the specific threshold for an acceptable DSCR may vary depending on the industry and the lender’s requirements.

Here’s how a DSCR loan typically works:

1) Evaluation of Borrower’s Income – The lender assesses the borrower’s income sources, such as rental income, business revenue, or other cash inflows. They calculate the borrower’s net operating income (NOI) by subtracting operating expenses from the gross income.

2) Calculation of Debt Service Coverage Ratio – Using the DSCR formula mentioned above, the lender determines the borrower’s ability to cover the debt payments. A higher DSCR indicates a stronger ability to service the debt.

3) Lender’s Required DSCR Threshold – Lenders usually have a minimum DSCR requirement for approving the loan. This threshold varies depending on the lender, loan type and industry.

For example, a lender may require a DSCR of 1.25, meaning the net operating income should be 1.25 times the debt service.

4) Loan Amount Determination – Based on the borrower’s income and the lender’s required DSCR, the lender determines the maximum loan amount they are willing to offer. This amount is calculated by dividing the net operating income by the required DSCR.

5) Loan Terms and Conditions – Once the loan amount is determined, the lender sets the loan terms and conditions, including the:

- interest rate,

- repayment period,

- any collateral requirements.

These terms may vary based on the lender’s policies and the borrower’s creditworthiness.

6) Loan Repayment – The borrower makes regular monthly or quarterly payments of the Loan’s Principal and Interest. The lender monitors the borrower’s financial performance during the loan term to ensure the DSCR stays within acceptable bounds.

DSCR Loan Requirements

Before applying for a DSCR loan, it’s essential to know about the requirements. Lenders will typically require certain financial documentation, such as:

- tax returns,

- financial statements,

- bank statements.

Additionally, lenders consider factors like credit score, property type, location and borrower experience when evaluating loan applications.

DSCR Loan Pros and Cons

| S.no. | Pros | Cons |

|---|---|---|

| 1. | High Borrowing Capacity | Stringent Eligibility Criteria |

| 2. | Lower Interest Rates | Potentially Higher Down Payments |

| 3. | Longer Repayment Terms | Possible Collateral Requirement |

| 4. | Improved Cash Flow | Limited Flexibility in Loan Usage |

| 5. | Greater Financial Stability | Risk of Loan Default or Foreclosure |

| 6. | Favorable for Income-Generating Assets | Limited Availability for Certain Properties |

| 7. | Can Enhance Property Valuation | Potential Prepayment Penalties |

| 8. | Tax Deductibility of Interest Payments | Requires thorough financial documentation |

Who offers DSCR Loans?

DSCR loans are typically offered by commercial banks, financial institutions and specialized lenders.

These lenders have experience in underwriting and assessing the creditworthiness of commercial borrowers.

Here are some common entities that may offer DSCR loans:

- Commercial banks – Large national and regional banks often provide DSCR loans as part of their commercial lending services.

- Credit unions – Some credit unions offer DSCR loans to their business members.

- Non-bank lenders – Non-bank financial institutions such as private lenders and online lenders may offer DSCR loans to businesses.

- Small Business Administration (SBA) – The SBA offers various loan programs, including those that consider DSCR as part of the eligibility criteria.

- Development finance institutions – These organizations specialize in providing financing for infrastructure and development projects and may offer DSCR loans.

- Real estate investment trusts (REITs) – REITs may offer DSCR loans for real estate investments.

- Commercial mortgage lenders – Lenders specializing in commercial mortgages often consider DSCR when evaluating loan applications.

What Banks offer DSCR loans?

Several banks and financial institutions offer DSCR loans.

Here are some well-known banks that may provide DSCR loans:

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Citigroup Inc.

- Goldman Sachs Group Inc.

- U.S. Bank

- PNC Financial Services Group Inc.

- TD Bank Group

- HSBC Holdings plc

- Barclays PLC

Also See: 15 Best Strategies to Reduce Your Total Loan Cost

DSCR Loan rates in 2023

| Loan Type | DSCR Loan Rates in 2023 |

|---|---|

| Commercial Mortgage | 4.25% – 5.25% |

| Small Business Loan | 6.00% – 7.50% |

| Real Estate Loan | 4.50% – 6.00% |

| Construction Loan | 5.50% – 7.00% |

| Equipment Financing | 5.75% – 7.25% |

| Business Acquisition Loan | 6.50% – 8.00% |

DSCR Loan Calculator

FAQs

Do banks give DSCR loans?

Yes, banks offer Debt Service Coverage Ratio (DSCR) loans,

What is needed to qualify for a DSCR loan?

Sufficient income and cash flow to meet debt service requirements, typically a Debt Service Coverage Ratio (DSCR) of 1.25 or higher is required.

How much do you have to put down on a DSCR loan?

The down payment required for a Debt Service Coverage Ratio (DSCR) from 20% to 30% of the property’s purchase price.

Are DSCR loans hard money?

No, DSCR (Debt Service Coverage Ratio) loans are not hard money loans. They are typically conventional loans based on the income of the property being financed.

Can I live in a home bought with a DSCR loan?

Yes, you can live in a home bought with a Debt Service Coverage Ratio (DSCR) loan, as it is typically used for investment properties.

Does a DSCR loan need appraisal?

Yes, a DSCR (Debt Service Coverage Ratio) loan typically requires an appraisal to determine the value of the property being used as collateral.

Do DSCR loans have PMI?

No, DSCR (Debt Service Coverage Ratio) loans do not require private mortgage insurance (PMI) as they are primarily used for commercial real estate and investment properties.

Are DSCR loans more expensive?

DSCR loans have higher interest rates and fees compared to traditional loans due to the increased risk for lenders.

Can I refinance with a DSCR loan?

Yes, it is possible to refinance with a DSCR loan which focuses on the property’s cash flow rather than personal income.

What is a good DSCR in real estate?

A good Debt Service Coverage Ratio (DSCR) in real estate lies between 1.25 to 1.5.

Does DSCR include taxes?

No, the Debt Service Coverage Ratio (DSCR) does not include taxes. It is a measure of a company’s ability to cover its debt obligations with its operating income.

Final Words

Securing a DSCR loan for your real estate investments can provide the necessary financing to pursue lucrative opportunities.

By understanding the concept of DSCR, assessing your eligibility, preparing strong financial statements and building a compelling loan application, you can enhance your chances of obtaining a DSCR loan.

Remember to research and select lenders wisely, maintain effective communication throughout the process and actively manage the loan once obtained.

With proper planning and preparation, you can confidently pursue DSCR loan opportunities and take your real estate investments to new heights.