In today’s digital age, online lending platforms have gained popularity for their convenience and accessibility.

FastLoanAdvance.com is one such platform that offers quick loans to individuals in need.

However, before entrusting your financial information and personal data to any online platform, it’s crucial to determine its legitimacy.

In this blog, we will conduct a detailed evaluation of FastLoanAdvance.com to help you make an informed decision.

What is FastLoanAdvance.com?

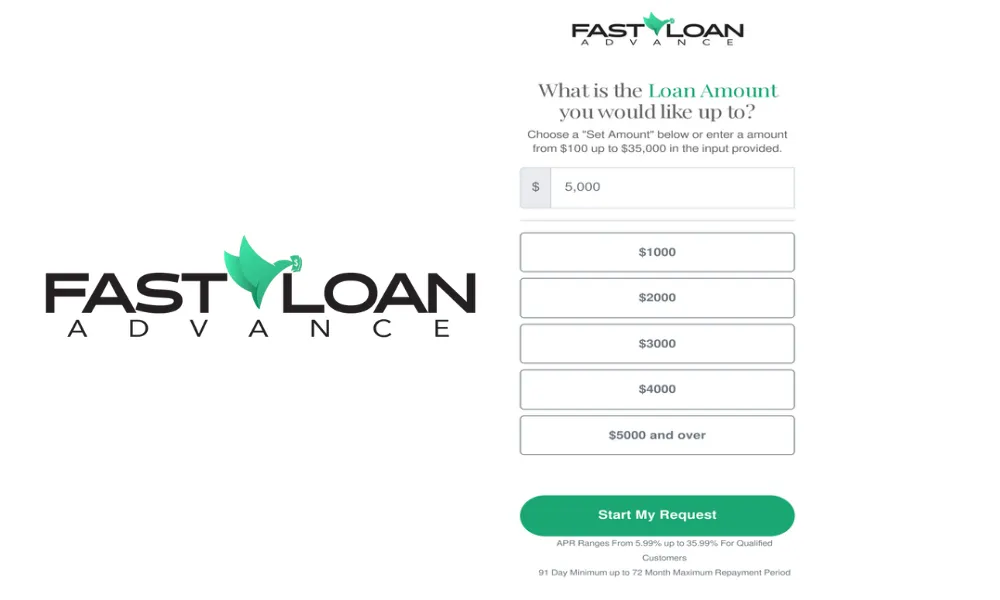

FastLoanAdvance.com is an online lending platform that provides quick loans to borrowers.

Established in 2018, the platform aims to offer a hassle-free borrowing experience. It claims to cater to a wide range of individuals, including those with poor credit histories.

With an emphasis on fast approval and minimal documentation, FastLoanAdvance.com targets borrowers seeking immediate financial assistance.

Evaluating Legitimacy

To determine the legitimacy of FastLoanAdvance.com, it is essential to conduct thorough research and analyze various aspects.

Researching the company’s reputation and track record:

- Customer reviews and testimonials – Exploring online platforms and forums for feedback from previous borrowers can provide valuable insights into their experiences with FastLoanAdvance.com.

- Reported scams or fraudulent activities – Checking reliable sources such as consumer protection agencies or financial authorities for any reported scams or fraudulent activities associated with FastLoanAdvance.com is crucial.

Verification of licensing and regulatory compliance:

- Compliance with financial regulations – Assessing whether FastLoanAdvance.com complies with relevant financial regulations and follows industry standards ensures the platform operates within legal boundaries.

- Presence of proper licensing and accreditation – Verifying if FastLoanAdvance.com holds the necessary licenses and certifications from regulatory bodies adds to its credibility.

Is FastLoanAdvance.com Legit?

Without a doubt, fastloanadvance.com is a legit & trustworthywebsite.

However, there is no 100% assurance that your application for a loan from rapid cash advance will be authorized.

Rather, on fastloanadvance.com you are told about some lenders who are ready to give you loan after looking at your income and debt.

I used Fast Loan Advance to request for a $5,000 loan and the next day I got the money.

You can still acquire the loan even with less-than-perfect credit, but the interest rate will be somewhat higher.

Assessing Security and Privacy

The security of personal and financial information is paramount when dealing with online lending platforms.

Data protection measures:

- Privacy policy and terms of service – Reviewing FastLoanAdvance.com’s privacy policy and terms of service helps understand how the platform collects, stores and protects user data.

- Usage of encryption and secure protocols – Evaluating whether FastLoanAdvance.com employs encryption technology and secure protocols (such as SSL) safeguards user information from unauthorized access.

Handling of personal information:

- Data collection, storage and sharing – Assessing how FastLoanAdvance.com collects, stores and shares personal information ensures transparency and compliance with data protection laws.

- Adherence to data protection laws – Verifying if FastLoanAdvance.com follows relevant data protection laws further reinforces its legitimacy.

Transparency and Disclosure

A reputable lending platform should provide transparent and fair loan terms and conditions.

Loan terms and conditions:

- Interest rates, fees and repayment options – Scrutinizing the interest rates, fees and repayment options offered by FastLoanAdvance.com helps determine the fairness of their loan terms.

- Clarity and comprehensibility – Assessing the clarity and comprehensibility of the terms and conditions ensures borrowers have a clear understanding of their obligations.

Customer support and assistance:

- Communication channels – Evaluating the availability of communication channels such as phone, email, or live chat allows borrowers to seek assistance whenever required.

- Responsiveness and helpfulness – Considering customer feedback regarding the responsiveness and helpfulness of FastLoanAdvance.com’s customer service team can indicate the platform’s commitment to addressing borrower concerns.

FastLoanAdvance.com Loan Costs & All Applicable Fees

| LOAN AMOUNT | $1,000 | $2,000 | $5,000 | $10,000 |

| INTEREST RATE | 24% | 19% | 13% | 8% |

| LOAN TERM | 12 Months | 24 Months | 48 Months | 60 Months |

| FEE | 3% | 5% | 8% | 10% |

| FEE COST | $30 | $100 | $400 | $1,000 |

| REPAYMENT | $94.56 | $100.82 | $131.67 | $202.28 |

| APR (Annual Percentage Rate) | 29.82% | 24.12% | 18.23% | 9.20% |

| TOTAL PAYMENTS | $1,134.72 | $2,419.68 | $6,320.12 | $12,136.80 |

| TOTAL COSTS | $164.72 | $519.68 | $1,720.12 | $3,136.80 |

FastLoanAdvance.com Standard Personal Loan Terms

| Loan amount | $500 – $35,000 |

| Lending period | 1 days – 72 months for qualified users |

| Payment frequency | Once or twice a month |

| APR | Based on your credit score, repayment history and other factors. |

FAQs

What is fast loan advance?

FastLoanAdvance.com is a website that provides quick loans or advances to borrowers, allowing them to access funds rapidly for various personal or financial needs.

How do I know if my online loan is legit?

Contact the lender or financial institution that issued the loan number and provide them with the loan number for verification.

Does fake loan affect credit score?

No, fake loans typically do not affect credit scores unless they are reported to credit bureaus as delinquent or unpaid debts.

Are instant loan apps safe?

Instant loan apps can be risky. Some are legitimate, but many have high interest rates, hidden fees and may misuse personal information. Caution is advised.

How do you check if a loan app is registered or not?

Verify the loan app’s registration by checking with the relevant financial regulatory authorities or consulting online databases for authorized lenders.

How do I verify a loan number?

Contact the lender directly via phone or email to verify the loan number. Do not provide personal information unless you have confirmed their identity.

Conclusion

When considering using FastLoanAdvance.com or any other online lending platform, it is crucial to conduct a thorough evaluation to determine its legitimacy.

By researching the company’s reputation, verifying licensing and regulatory compliance, assessing security and privacy measures, reviewing transparency and disclosure practices and comparing it with alternatives, borrowers can make informed decisions and mitigate risks associated with online lending platforms.

Remember, your financial security is paramount and due diligence is key.