Understanding the elements that go into your overall loan balance is essential when it comes to loans.

In case, you have a mortgage, car loan, student loan or any other type of borrowing, being aware of what increases your total loan balance can help you make informed financial decisions.

In this blog post, we will delve into various factors that can increase your total loan balance and explore strategies for managing them effectively.

What are Interest Rates?

Interest rates refer to the percentage of money charged or earned on a loan, investment or deposit.

They are essentially the cost of borrowing money or the reward for lending or investing funds.

Interest rates are expressed as a percentage of the principal amount and are typically charged over a specific period such as annually, monthly or daily.

Different Types of Interest Rates

| Type of Interest Rate | Description | Typical Application |

|---|---|---|

| Fixed Interest Rate | A set interest rate that remains unchanged for the entire loan term. | Mortgage loans, personal loans |

| Variable Interest Rate | An interest rate that can change over time, typically tied to an index such as the prime rate. | Credit cards, adjustable-rate mortgages |

| Prime Rate | The interest rate that banks charge their most creditworthy customers. | Commercial loans, lines of credit |

| Discount Rate | The rate at which the Federal Reserve lends money to banks. | Monetary policy, bank liquidity |

| Annual Percentage Rate (APR) | The cost of borrowing expressed as a yearly interest rate, including fees and other charges. | Credit cards, consumer loans |

| Nominal Interest Rate | The stated interest rate without considering inflation or compounding. | Basic savings accounts, bonds |

| Real Interest Rate | The interest rate adjusted for inflation, providing a more accurate measure of purchasing power. | Investments, economic analysis |

| Effective Interest Rate | The actual interest rate accounting for compounding, fees, and other costs. | Savings accounts, loans with fees |

What is Interest Capitalization?

Interest capitalization is a process in which unpaid interest on a loan or debt is added to the outstanding principal balance.

Instead of making interest payments as they accrue, the unpaid interest is capitalized or added to the principal balance, effectively increasing the overall amount owed.

When interest is capitalized, it becomes part of the principal balance and future interest calculations are based on the higher amount.

This statement includes both the original principal and the cumulative interest that has been added to the amount that is subject to interest charges.

This means that the borrower must pay interest on top of interest.

Interest capitalization commonly occurs in long-term loans such as student loans or mortgages.

During certain periods such as the grace period after graduation or a deferment period, borrowers may have the option to postpone making interest payments.

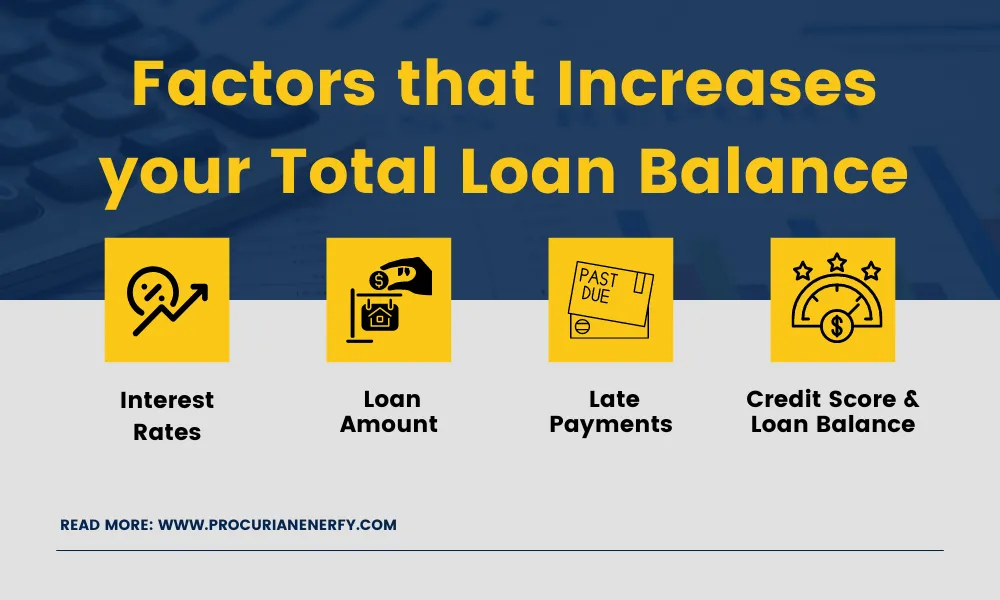

Factors that increases your total loan balance

Here are the factors that increases your total loan balance:

1. Accrued Interest

Accrued interest is the interest that has been earned but not yet paid or received. When you invest in a bond, loan or any other interest-bearing instrument, you earn interest over time.

When you invest in a bond, loan or any other interest-bearing instrument, you earn interest over time.

The interest accrues or accumulates in between the interest payment periods.

As a result, even if you haven’t gotten your interest payment yet, you’ve still racked up interest since the prior one.

Depending on the interest rate and the interval between payments, the amount of accumulated interest rises everyday.

The formula for calculating accrued interest is:

Accrued Interest = Principal × Interest Rate × Time

In this formula:

- Principal – The initial amount of money on which the interest is calculated.

- Interest Rate – The rate at which the interest is being charged or earned, usually expressed as a percentage.

- Time – It represents the time period for which the interest is being calculated, typically in years.

Accrued Interest Calculator

2. Loan Term

The duration or term of your loan also affects your total loan balance.

Shorter loan terms generally result in higher monthly payments but can help reduce your overall balance quicker due to less time for interest to accumulate.

Longer loan terms may offer lower monthly payments but can lead to a higher total loan balance in the long run.

3. Loan Amount

The amount you borrow has a direct correlation with your total loan balance.

Higher loan amounts naturally lead to larger balances.

When considering borrowing, it’s essential to evaluate the loan amount carefully and borrow only what you truly need to avoid unnecessarily increasing your loan balance.

4. Repayment Frequency

The frequency at which you make loan repayments can impact your loan balance.

More frequent payments, such as bi-weekly or weekly, can help reduce your balance faster as you make more payments over time.

However, be sure to check if your lender allows for more frequent repayments without penalties.

5. Late Payments and Fees

Late payments and associated fees can significantly increase your loan balance.

Missing payments or making them past the due date can result in additional interest charges and penalties, adding to your total balance.

To avoid this, it’s crucial to make timely payments and stay on top of your loan obligations.

6. Additional Borrowing

Taking on additional loans while having an existing loan balance can increase your total loan balance.

It’s crucial to thoroughly assess the necessity for more borrowing and take into account the potential effects it can have on your entire financial status.

In some cases, debt consolidation might be a viable option to manage multiple loans and potentially reduce your total loan balance.

7. Credit Score and Loan Balance

The conditions of your loan are significantly influenced by your credit score.

A lower credit score will result in higher interest rates which will increase your loan debt.

You might be able to secure better loan terms and eventually pay off your debt more rapidly if you work to improve your credit score.

8. Loan Modifications

In certain situations, borrowers may request loan modifications to change the terms of the loan such as-

- extending the repayment period,

- changing the interest rate, or

- adjusting the monthly payments.

Depending on the modification terms, it can impact the total loan balance.

Reducing your total loan cost

Reducing your total loan cost involves implementing strategies to minimize the overall expense associated with borrowing money.

- Exploring options to secure loans with lower interest rates, which can significantly reduce the cost over the loan’s duration.

- Additionally, making larger down payments or increasing monthly payments can shorten the loan term and decrease interest accrual.

- Refinancing an existing loan to take advantage of lower interest rates is another effective approach.

- Avoiding unnecessary fees, negotiating favorable loan terms and maintaining a good credit score can further contribute to reducing the total loan cost.

Overall, a combination of careful planning, research and prudent financial management can help achieve a lower total loan cost.

Loan Re-payment Calculator

Monthly Payment:

FAQ’s

Why is my personal loan balance increasing?

Your personal loan balance may be increasing due to accruing interest, late payment fees or additional charges.

How can you reduce your total loan cost FAFSA?

To reduce your total loan cost through FAFSA, consider maximizing grants and scholarships, exploring work-study opportunities, attending an affordable college and managing your expenses wisely during your education.

who do you contact if you’ve already accepted more loan money than you need?

Contact your loan provider or financial aid office to discuss your situation and explore options for returning the excess funds or adjusting your loan amount.

What percentage of gross salary for student loan repayment

The percentage of gross salary for student loan repayment can vary depending on the country and loan program but it typically ranges from 5% to 15%.

Conclusion

Understanding the factors that increase your total loan balance empowers you to make informed decisions and effectively manage your loans.

Factors such as interest rates, loan terms, loan amounts, repayment frequency, late payments, additional borrowing and credit score all contribute to your overall balance.

By considering these factors and implementing strategies to minimize their impact, you can work towards maintaining a manageable loan balance and achieving greater financial stability.

Remember, proactive loan management is key, and by staying informed, you can take control of your financial future.