Personal loans have become a popular financial tool for individuals seeking flexibility and convenience in managing their finances.

Whether you need to cover unexpected expenses, consolidate high-interest debt, finance home improvements or invest in education or career development, a personal loan can provide the necessary funds.

Before applying, it’s crucial to understand the benefits that come with obtaining a personal loan.

The benefits of personal loans and how they might support your financial objectives will be discussed in this blog article.

What is the meaning of personal loan?

A personal loan is a amount of money that has been borrowed and given to a person by a lender or financial organization for personal use.

It is typically unsecured, meaning it doesn’t require collateral and can be used for various purposes such as debt consolidation, home improvements or unexpected expenses.

What are the benefits of getting a personal loan?

The benefits of getting a personal loan are:

- Flexible Use of Funds.

- Quick and Convenient Application Process.

- Improving Credit Score.

- Repayment Flexibility.

- No Collateral Required.

- Fixed interest rates and fixed monthly payments.

- Offer a relatively quick and straightforward application process.

What is a benefit of obtaining a personal loan getting money with special repayment terms?

One benefit of obtaining a personal loan with special repayment terms is the flexibility it offers in managing your finances.

Special repayment terms such as lower interest rates, extended repayment periods or customizable payment schedules can make it easier to budget and repay the loan according to your specific financial situation.

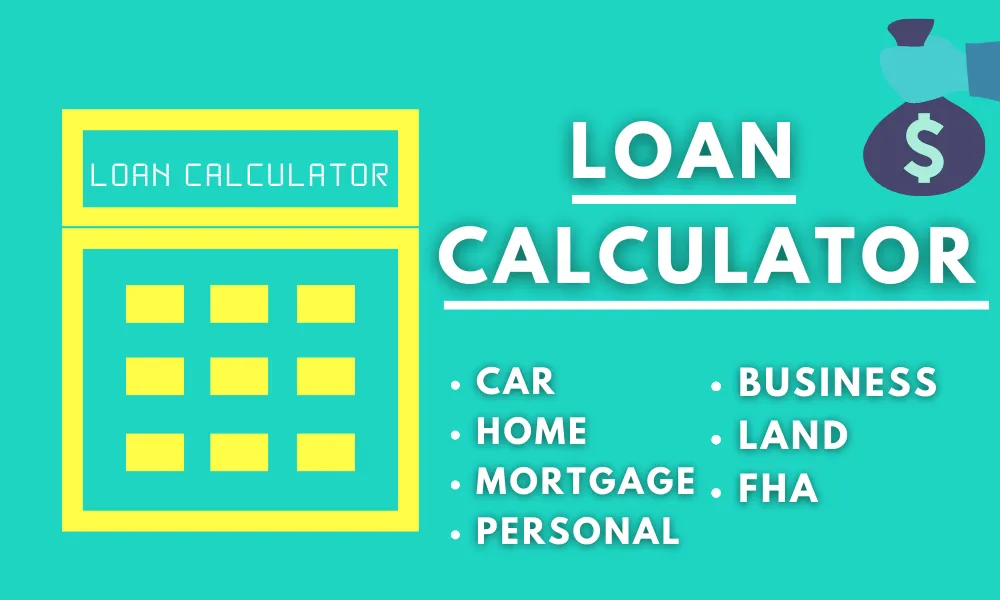

What are the benefits of using personal loan calculator?

A personal loan calculator provides several benefits.

- It helps you estimate loan repayment amounts, interest rates and the overall cost of borrowing.

- It enables you to compare different loan options, make informed financial decisions and plan your budget effectively.

- It saves time, offers convenience and promotes financial transparency.

What is the best reason why I need a personal loan to tell the bank?

When approaching a bank for a personal loan, it’s important to provide a valid and compelling reason for borrowing the funds.

One of the best reasons to seek a personal loan is to finance home improvement projects.

Whether you want to renovate your kitchen, add a new bathroom or make necessary repairs, home improvements can increase the value of your property and enhance your quality of life.

List of loan personal purpose reasons:

- Debt Consolidation

- Home Renovations

- Education Expenses

- Medical Expenses

- Wedding Expenses

- Travel and Vacation

- Vehicle Purchase

- Emergency Situations

- Small Business Funding

- Special Occasions

- Adoption Expenses

- Legal Fees

- Funeral Expenses

- Personal Development

- Technology and Electronics

Is personal loan best option?

Whether a personal loan is the best option depends on individual circumstances. Personal loans can be useful for consolidating debt or funding major expenses.

However, they come with interest rates and fees, and it’s important to consider alternatives like savings or lower-interest options before deciding if a personal loan is the best choice for you.

What credit score do I need to apply for a personal loan?

Generally, a credit score of 650 or higher is considered good and increases your chances of approval, while scores below 650 may result in higher interest rates or limited options.

How does a personal loan increase credit score?

A personal loan can increase your credit score by demonstrating responsible credit management.

Making timely loan payments and diversifying your credit mix by adding an installment loan can improve your payment history and credit utilization ratio, both of which are factors considered in credit scoring models.

Do banks give personal loans easily?

The ease of obtaining a personal loan from banks depends on various factors:

- the borrower’s credit history.

- income stability.

- overall financial profile.

Banks typically have specific criteria and requirements for loan approval. Individuals with strong creditworthiness and a steady income are more likely to obtain loans easily.

What disqualifies you from getting a personal loan?

Several factors can disqualify you from obtaining a personal loan:

- a low credit score

- insufficient income

- a high debt-to-income ratio

- a history of late payments or defaults.

- lack of collateral

- a recent bankruptcy

Each lender has specific criteria, so it’s important to check their requirements beforehand.

Can you pay off a personal loan early?

Yes, in most cases you can pay off a personal loan early.

However, it’s important to check the terms and conditions of your loan agreement to ensure there are no prepayment penalties or fees associated with early repayment.

Contact your lender for specific details regarding your loan.

What type of personal loan is easiest to get approved for?

The easiest type of personal loan to get approved for is usually a secured personal loan, where the borrower offers collateral such as a car or savings account.

Secured loans are less risky for lenders as they have an asset to recover in case of default.

Does a personal loan go into your bank account?

Yes, a personal loan goes directly into your bank account.

After the loan is approved and the necessary documentation is completed, the lender transfers the loan amount to the designated bank account. From there, you can access the funds and use them as needed.

What is the risk of a personal loan?

The risk of a personal loan primarily lies in the borrower’s ability to repay the borrowed amount.

If the borrower defaults on payments, it can lead to:

- damaged credit,

- collection efforts and

- legal consequences.

Additionally, high interest rates, hidden fees and borrowing beyond one’s means can further increase the risk.

Is applying for a personal loan a hard inquiry?

Yes, applying for a personal loan typically results in a hard inquiry on your credit report.

Hard inquiries occur when a lender reviews your credit history as part of the loan application process.

These inquiries can temporarily lower your credit score by a few points.

Can you return a personal loan if you don’t use it?

Typically, personal loans are not returnable if you don’t use them.

No matter how the borrower uses the money once a personal loan has been approved and given, they are still responsible for paying it back in full.

It is important to carefully consider the need for a loan before applying.

Is personal loan good for investment?

No, personal loans are not considered a good option for investment purposes.

Personal loans usually come with higher interest rates compared to other forms of borrowing and they are more suitable for personal expenses or emergencies rather than investments, which carry their own risks and considerations.

How to make money with personal loan?

To make money with a personal loan, you could invest it in a high-yield opportunity such as:

- starting a small business,

- investing in stocks or real estate, or

- lending it to others at a higher interest rate.

However, these methods carry risks and careful research and financial planning are essential for success.

Advantages and disadvantages of personal loan

| Advantages of Personal Loans | Disadvantages of Personal Loans |

|---|---|

| Flexibility | Higher Interest Rates |

| Versatile Use | Impact on Credit Score |

| No Collateral Required | Fees and Charges |

| Quick Approval and Disbursement | Borrowing Limits |

| Fixed Interest Rates | Debt Trap Potential |

Do personal loan lenders call your employer?

Some personal loan lenders may contact your employer as part of their verification process.

However, not all lenders do this, and it ultimately depends on their specific policies and the information you provide during the loan application.

Can personal loan companies see your bank account?

Yes, personal loan companies typically require access to your bank account statements during the loan application process.

This allows them to verify your financial stability, income and repayment ability.

However, they generally do not have ongoing access to your account once the loan is approved and disbursed.

How fast can I get my personal loan?

Some lenders offer quick approval and disbursal, potentially within 24 to 48 hours, while others may take longer.

The speed at which you can receive your personal loan depends on several factors:

- lender’s processing time,

- the completeness of your application, and

- the required verification process.

How many years is a personal loan good for?

A standard personal loan has a repayment period of 2 to 5 years.

Long-term personal loans may have loan repayment terms of up to 15 years.

The monthly payment becomes more manageable in return for deferring interest payments for a longer period of time.