Welcome to ProCurian!

Financial independence is a crucial milestone for young adults as they embark on their journey into adulthood.

One aspect of achieving financial independence is obtaining a loan.

Whether it’s for education, starting a business or making a major purchase, loans can provide the necessary financial boost.

In this post, we’ll examine the processes and strategies that can enable you to obtain a loan at the age of 18.

To begin, let’s define loans and credit.

What are Loans and Credit?

A loan is a sum of money borrowed from a lender that must be repaid over a specific period, typically with interest.

Credit is the financial reputation and ability to borrow money based on your credit history and credit score.

At 18, you may have limited or no credit history which can make the loan process a bit challenging.

How can an 18 year old get a loan?

When it comes to loans for 18-year-olds, it’s important to consider that most traditional lenders may have strict eligibility criteria that require a credit history or a co-signer.

However, there are still several options available for young adults looking for loans.

Here are a few options to get a loan at age of 18:

1) Student Loans

Student loans are made exclusively for paying for college.

There are two main types of student loans: federal & private.

Government-sponsored federal student loans provide lower interest rates and more flexible payback terms. To apply for federal student loans, you need to fill out the “Free Application for Federal Student Aid (FAFSA)”

Banks, credit unions and other financial entities provide private student loans. They could have more expensive interest rates and rigider repayment conditions, but they are a choice if you want more money than what government loans can provide.

2) Secured Credit Builder Loans

These loans are specifically designed to help individuals with limited or no credit history build credit.

With a secured credit builder loan, you provide collateral such as a savings account or a CD, which serves as security for the loan.

The loan amount is typically equal to the collateral you provide.

As you make regular payments on time, the lender reports your positive payment history to the credit bureaus which helps establish your credit history.

3) Co-Signed Personal Loans

If you have a parent, guardian or another trusted adult who is willing to co-sign the loan with you, it can increase your chances of qualifying for a personal loan.

When someone co-signs a loan, they are legally responsible for the debt if you default on payments.

By having a co-signer with a stronger credit history and income, lenders may be more willing to offer you a loan.

However, co-signing carries a lot of responsibility, therefore it’s critical to understand that before proceeding, all parties should be thoroughly informed of the terms and consequences.

4) Credit Union Loans

Credit unions are financial institutions that are member-owned and often offer more favorable terms for borrowers compared to traditional banks.

They typically prioritize building relationships with their members and may be more willing to work with young borrowers who have limited credit history.

Credit unions may have special loan programs tailored for young adults such as credit-builder loans or low-interest personal loans.

It’s worth exploring credit union options in your area to see if they offer loan products suitable for your needs.

5) Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with individual lenders. These platforms allow borrowers to create a loan listing, describing their needs and financial situation.

Potential lenders review these listings and decide whether to fund the loan based on the borrower’s profile.

P2P lending platforms often consider factors beyond just credit scores, such as:

- educational background,

- employment history, or

- future prospects.

This approach can make them more accessible for young borrowers who may not have an extensive credit history.

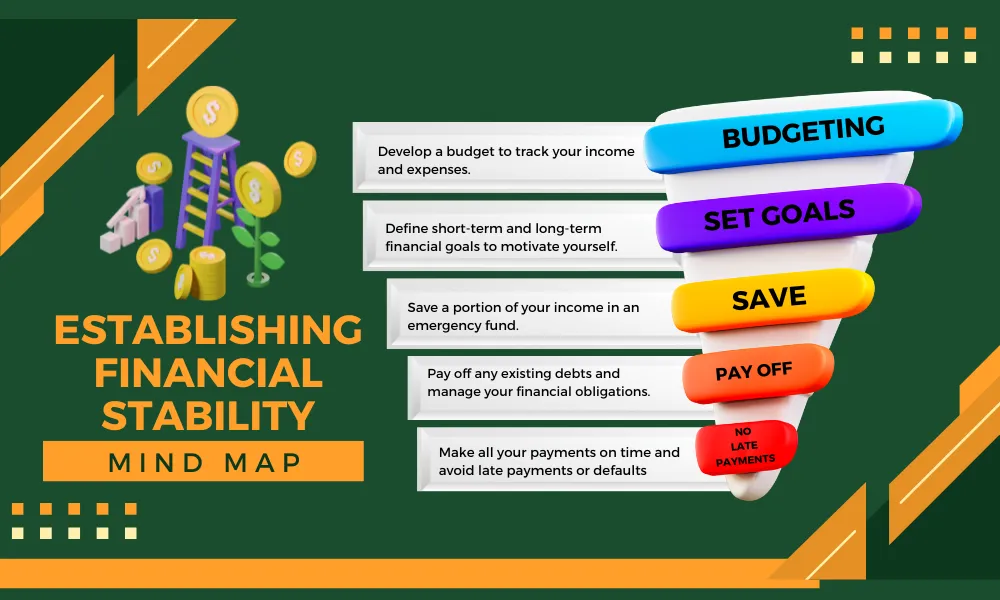

Establishing Financial Stability

Lenders want to ensure that you have a stable financial foundation before approving your loan application.

Take the following steps to demonstrate financial stability:

1) Develop a budget to track your income and expenses, ensuring you have sufficient funds to meet your loan obligations.

2) Define short-term and long-term financial goals to motivate yourself and establish a sense of direction.

3) Save a portion of your income in an emergency fund to cover unexpected expenses and demonstrate financial responsibility.

4) Pay off any existing debts and manage your financial obligations responsibly. Lenders will assess your debt-to-income ratio when evaluating your loan application.

5) Make all your payments on time and avoid late payments or defaults, as this will positively impact your credit history.

Steps to build a good credit history:

- Open a bank account and manage it responsibly.

- Apply for a credit card or become an authorized user on a parent’s card, making timely payments.

- Consider a small personal loan or a credit-builder loan from a local credit union.

- Regularly review your credit reports and dispute any errors.

Loan repayment strategies you must follow

Once you secure a loan, it’s important to plan for its repayment to avoid any financial stress or potential consequences. Consider the following strategies:

1) Develop a repayment plan that fits your budget, ensuring you allocate sufficient funds to cover monthly loan payments.

2) Opt for automatic payments to ensure timely and consistent repayment, reducing the risk of missed or late payments.

3) Make loan repayment a priority in your budget, allocating funds accordingly and minimizing unnecessary expenses.

4) Missing loan payments can negatively impact your credit score and result in penalties. Stay organized and make payments on time to maintain a positive financial reputation.

5) Consider making extra payments or paying more than the minimum required amount to accelerate your loan repayment. This can help save money on interest and shorten the loan term.

Maintaining a healthy financial future

Obtaining a loan at 18 is just the beginning of your financial journey. To ensure a prosperous future, regularly review your credit reports to ensure accuracy and address any potential issues.

Borrow only what you need and avoid taking on unnecessary debt. Responsible borrowing and managing your debt load will contribute to your financial stability.

Develop habits such as:

- saving,

- budgeting and

- tracking your expenses.

These habits will help you maintain financial discipline and build a solid foundation for the future.

Educate yourself about investing, saving for retirement and other avenues for financial growth.

Start early and take advantage of compounding interest to maximize your savings.

If you have complex financial situations or need guidance, consider consulting with a financial advisor who can provide personalized advice tailored to your specific needs.

FAQs

Can an 18 year old take a loan?

Yes, an 18-year-old can take a loan but eligibility may depend on factors such as income, credit history and loan type.

How to get a small loan at 18 with no credit?

Research local credit unions, online lenders or peer-to-peer lending platforms. Consider getting a cosigner or using collateral to increase your chances of approval.

How to get approved for a personal loan at 18?

To increase your chances of getting approved for a personal loan at 18, build a good credit score, have a stable income and consider applying with a cosigner.

Can an 18 year old get a loan for a car?

Yes, an 18-year-old can potentially get a loan for a car, but eligibility and terms may vary depending on factors like income, credit history and lender requirements.

Can you get a loan at 18 without a job?

It may be challenging to get a loan at 18 without a job since lenders typically require a source of income and a credit history.

Can you get a loan at 18 without a cosigner?

Yes, it is possible to get a loan at 18 without a cosigner, but it depends on your credit history and the lender’s requirements.

Final words

Securing a loan at the age of 18 is an important step towards financial independence.

By understanding loans and credit, researching loan options, establishing financial stability and following the necessary steps to secure a loan, you can successfully navigate the loan process.

Remember to prioritize responsible borrowing, diligently repay your loans and maintain good financial habits for a healthy financial future.

Take control of your finances and set yourself up for long-term success.