Welcome to the loan section of ProCurian.

Having no credit history can make it challenging to secure a loan.

Since creditworthiness is a key factor in loan acceptance, lenders typically use credit ratings to assess a borrower’s potential to repay loans.

In this blog, we’ll go through helpful advice and other options for acquiring a loan without a credit history.

Understanding Credit and its significance

Credit history is a record of an individual’s borrowing and repayment activities, while a credit score is a numerical representation of their creditworthiness.

Lenders use these factors to evaluate the risk associated with lending money.

A strong credit history and a high credit score increase your chances of loan approval. Lenders consider your creditworthiness to determine the interest rate, loan amount and terms they can offer you.

No credit history means that lenders have no information to assess your borrowing and repayment behavior.

This lack of credit history can lead to loan rejections or unfavorable terms.

However, there are still options available to secure a loan.

Is it possible to get a loan with no credit?

Yes, it is possible to get a loan with no credit, although it can be more challenging.

Traditional lenders commonly assess a borrower’s creditworthiness and set the terms of a loan using credit ratings.

However, there are alternative options available that may consider other factors in addition to credit history.

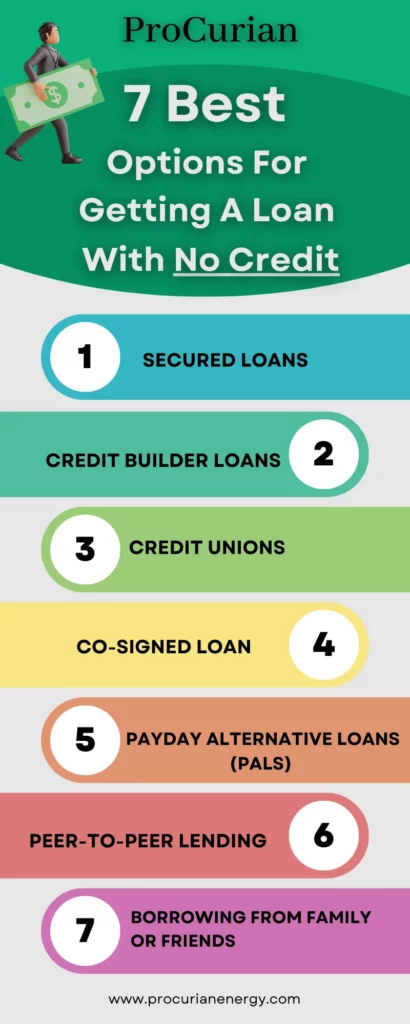

7 Best Options For Getting A Loan With No Credit

1) Secured Loans

With a secured loan, you must provide the lender with collateral as a kind of insurance.

By offering collateral, you reduce the lender’s risk, making it easier to obtain a loan even with no credit history.

Common examples of collateral include a car, home equity or a savings account.

If you default on the loan, the lender has the right to take possession of the collateral to recover their losses.

You should carefully review the loan’s terms and circumstances because defaulting might result in the loss of your collateral.

2) Credit Builder Loans

With a credit building loan, you typically borrow a little sum and the lender retains that money in a separate account.

You then make regular payments, usually monthly, over a predetermined period.

Once the loan term is up, all payments have been paid and you have built a solid credit history, the lender returns the loan amount to you.

Credit builder loans are typically offered by credit unions, community banks and online lenders.

These loans may have higher interest rates or fees, but they provide an opportunity to establish credit when other options are limited.

3) Credit Unions

Credit unions are financial institutions that are owned and operated by their members.

They often have a community focus and are more willing to work with individuals who have no credit or limited credit history. Credit unions may offer starter loans or credit-building programs to help you establish credit.

These loans often have lower interest rates and fees compared to traditional banks.

To join a credit union, you typically need to meet certain eligibility requirements, such as living or working in a specific area or being a member of a particular organization.

It’s worth researching credit unions in your area and contacting them to inquire about their loan products for individuals with no credit.

4) Co-Signed Loan

A co-signed loan involves a creditworthy individual (co-signer) who agrees to take joint responsibility for the loan with you.

The co-signer’s good credit history and income can strengthen your loan application, increasing the chances of approval.

If you are unable to pay back the loan, the co-signer is fully responsible for the debt.

When considering a co-signed loan, it is essential to be open and truthful with the co-signer and to make sure that all parties are aware of the duties and potential consequences.

It’s also essential to make all loan payments on time to protect the co-signer’s credit and maintain a healthy relationship.

5) Payday Alternative Loans (PALs)

Payday Alternative Loans (PALs) are a potential option for obtaining a loan with no credit history.

Offered by some credit unions, PALs are small-dollar loans designed as an alternative to high-interest payday loans.

These loans typically have more affordable interest rates and longer repayment terms.

To qualify for PALs , you’ll need to be a member of the credit union and meet their eligibility criteria. PALs give customers the opportunity to establish credit history by making prompt payments.

They can operate as a launching pad for obtaining access to future loans from more traditional lenders while avoiding the exorbitant fees and abusive tactics associated with payday loans.

6) Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders through an online marketplace.

P2P lending can be an option for individuals with no credit, as lenders on these platforms often consider other factors beyond credit scores when evaluating loan applications.

To apply for a P2P loan, you must create a borrower profile and provide information about yourself and your financial situation.

Lenders will review your profile and decide whether to fund your loan.

It’s important to note that interest rates on P2P loans may be higher than those offered by banks or credit unions, as lenders are taking on more risk by lending to individuals without established credit histories.

7) Borrowing from Family or Friends

Borrowing money from family or friends can be an informal option if they are willing to lend to you.

However, it’s important to approach this option with care and establish clear repayment terms to avoid straining relationships.

When borrowing from family or friends, consider drafting a written agreement that outlines:

- the loan amount,

- repayment terms and

- any interest or fees.

This can help prevent misunderstandings and ensure that both parties are on the same page.

Treat this arrangement as you would any other loan and make timely repayments to maintain trust and a healthy relationship.

Tips for a Successful Loan Application

Gather all necessary documents, such as:

- identification,

- proof of income, and

- bank statements to present a comprehensive loan application.

Demonstrating financial stability and a steady income stream can help convince lenders of your ability to repay the loan.

Research multiple lenders and loan options to find the best fit for your needs.

Evaluate interest rates, fees and repayment terms.

Consider the overall affordability of the loan and choose an option that aligns with your financial situation.

FAQs

Is it possible to get a loan with no credit?

Yes, it is possible to get a loan with no credit.

Why is it challenging to get a loan with no credit?

No credit history makes it challenging to prove your ability to control your debt and make payments on time which makes it difficult for you to get approved for loan.

What are the options for getting a loan with no credit?

There are some options available to get a loan with no credit like personal loans from certain lenders, payday loans, secured loans, co-signing with a creditworthy individual or exploring alternative credit assessments.

What are personal loans for no credit?

These may include personal loans from certain lenders, payday loans, secured loans, co-signing with a creditworthy individual, or exploring alternative credit assessments.

How can I build credit if I have no credit history?

Building credit can be done by establishing a history of responsible borrowing and repayment. To start developing credit, you can apply for a secured credit card, add yourself as an authorized user on someone else’s card, or take out a small loan and make on-time, consistent payments on it.

Are there any risks associated with getting a loan with no credit?

Yes, there can be risks. Loans obtained without credit history often come with higher interest rates and fees to compensate for the perceived risk.

Can I get a loan with no credit if I’m a student?

As a student with no credit history, you may face some challenges when trying to get a loan. However, some lenders offer student loans specifically designed for individuals in your situation. Additionally, you can explore alternative options such as student credit cards or loans with a co-signer.

Final words

Obtaining a loan without a credit history may require some extra effort and exploring alternative options.

By considering secured loans, involving a cosigner or guarantor, exploring credit builder loans & alternative lenders and building your credit history over time, you can increase your chances of securing a loan in the absence of credit.

Remember, building credit is a long-term process and responsible borrowing and repayment practices are key to establishing a positive credit history for future financial opportunities.